The turning point in trucking lawsuits often lies within the deposition and discovery phase. You and your attorney will set the tone during discovery that carries through the rest of the case. This article contains premier safety culture advice from top leaders in the trucking industry.

One of the biggest factors that can determine the outcome of the lawsuit is the existing culture of safety in your company.

What is Culture?

Let’s break it down.

Culture is a collection of beliefs or systems held common between a group of people. Widespread groups could be as big as a country or even worldwide.

Language is an example of culture. English is the cultural language in the United States. While there are many different languages spoken in the states, it is the most commonly used between this particular group of people.

Culture can also refer to much smaller groups, even within your own immediate family. Think about your traditions, your habits, or even inside jokes between the people closest to you.

For example, during Thanksgiving dinner (which is also a cultural example), let’s say a particular family will only accept cranberry sauce in the shape of a can. If homemade cranberry sauce simply will not do, the family has created a traditional culture featuring cylindrical fruit spread with lines imprinted in the side.

For example, during Thanksgiving dinner (which is also a cultural example), let’s say a particular family will only accept cranberry sauce in the shape of a can. If homemade cranberry sauce simply will not do, the family has created a traditional culture featuring cylindrical fruit spread with lines imprinted in the side.

Silly, yes. But a clear example of how culture shifts between groups, as some families may find homemade cranberry sauce the only option. Once a culture is set and accepted by a group, it can be longstanding, even with no real foundation.

What is Safety Culture?

If you are reading this, you are likely already aware of what “safety” means in the trucking industry. For those of you who work in the safety department, this concept is woven into the fabric of your career.

But for those who think safety only refers to the safe operation of motor vehicles, you may be fascinated by this conversation. While truck drivers are expected to always drive safely, safety as a culture refers to so much more.

In trucking, safety personnel are responsible for:

Fleet-wide safe driving, clear communication, ongoing training, technology, data analysis, performance, reviews, coaching, corrective action, accountability, maintenance, federal regulations, time management, documentation, accident response, hiring and retention, orientation, and proper background check before the driver is even hired.

This is a snapshot of the job description of a safety professional. Good safety directors have policies and procedures in place to keep control of all aspects of safety. Great safety directors make sure their employees stick to their safety protocols daily.

Unbeatable safety directors make sure their company cares. That is safety culture. If a safety director can make every person in the company passionate about safety, a culture of safety will form. This culture of safety impacts everything from the company’s reputation to insurance renewal rates, even legal liability.

Why is Safety Culture Important?

A culture of safety starts when you hire the right team, hire the right risk manager, and you hire the right lawyer. Building the right team starts with you. Look for people that will be part of the safety culture you create.

Strong safety culture has even been the determining factor in some nuclear verdict lawsuits. Trucks are a big-ticket target for personal injury attorneys.

Why? Here are two scenarios. Both will take place on the same highway. Both accidents occurred under the same driving conditions, under clear skies, sunshine, and no visibility obstructions. The only difference is the day of the occurrence and the victims.

Scenario 1: A drunk driver in a beat-up, rusted, uninsured Chevy 2-door sideswipes the rear panel of a minivan on the highway. The minivan spins across two lanes of traffic and skids off the highway into a row of trees in the median.

All passengers were injured and taken to the hospital. One suffered only scratches and a stiff neck, but x rays of the other passengers revealed multiple broken bones.

Scenario 2: An 18-wheeler is traveling down that same highway, entering his 12th hour of driving that day. The driver of a giant SUV becomes distracted by an incoming text message.

The driver does not realize the trucker ahead indicated intent to change lanes a hundred yards back.

The truck driver uses the clear chance to slowly move into the other lane and never connects with the SUV.

The SUV driver, finally looking up from their phone, panics at the unfolding scenario, overcorrects the steering, and drives into the median into a row of trees.

The airbag deploys and the SUV driver is left with severe back and neck injuries that require surgery.

Which Case Would Win?

In scenario #1, the drunk driver was clearly at fault. The family may choose to sue the driver for putting them through so much pain and suffering. They may have difficulty finding a lawyer to take the case because:

- 1. The drunk driver has likely received an intoxicated citation, meaning justice was served.

- 2. The drunk driver was uninsured and driving an old, low-value vehicle. There is no insurance to cover the cost of a settlement.

- 3. Even if they win the case, they will likely never recoup the verdict award.

Attorneys will pounce on the chance to try scenario 2, however, since trucking companies are required to hold at least $750,000 in coverage.

Attorneys will pounce on the chance to try scenario 2, however, since trucking companies are required to hold at least $750,000 in coverage.

Technically, the truck driver was not at fault but was operating outside of federal regulations by driving over 11 hours that day. Even if the driver was alert and operating safely, that one detail can mean a nuclear verdict is coming.

Safety Culture Risks

Experience

Trucking has its fair share of newcomers; young drivers who did not grow up around trucking. It may be more of a job to them than a career. For a safety director, simply knowing that your company hires less experienced drivers can be a liability.

On the one hand, you can mold those drivers into proper truckers. Their lack of preconceived ideas gives you the opportunity to hire and train them based on your expectation.

The risk, however, lies in their lack of experience and perhaps their desperation to find a decent-paying job rather than their dedication to trucking.

When you bring them on, you must look for people who take pride in their work that you can build a long-term relationship. The longer they are with you, you build confidence in their performance.

Training

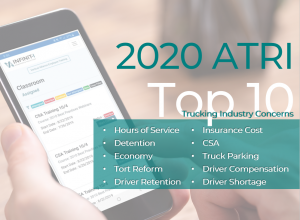

A majority of trucking companies are turning to technology to make their drivers better, reduce CSA scores, and prevent accidents. Since so many companies now employ regular training, the lack of a training system can be a liability.

Learning management systems are the ideal software solution for trucking companies. Mobile accessibility is a game-changer since truckers can participate from anywhere. Now, truckers can receive training individually from their phone rather than being routed into the terminal for safety training.

Training your drivers on a regular basis proves that you are focused on safety and being proactive. The jury will see that you are taking steps to prevent accidents, rather than only responding to them.

Policies

If you have a strict termination policy in place, make sure you follow it, especially if your policy includes the words “always” or never. If you get sued for an accident that included rare circumstances, these words can wrap you up in court.

For example, your best driver could be involved in an accident while talking to their dispatcher on a hands-free device. Even if this is the first offense for a 20-year veteran, you may have to consider termination. Especially if your policy states: “Drivers will never use mobile devices while operating a vehicle.”

If you get sued for the accident, plaintiff attorneys will research your policies during discovery. If you failed to terminate that driver, ignoring your own policy, you will be in a bad spot.

They will blast you on the witness stand in front of a jury. A great attorney can paint you as an evil monster and get the jury to turn against you. This is the Reptile Theory tactic. Read more about Reptile Theory in our eBook: Avoiding Nuclear Verdicts.

Avoiding Nuclear Verdicts eBook

Who You Need on Your Team.

Internally, you need a dedicated risk-safety individual who will stand up for you but has the temperament to handle drivers, the motoring public, lawyers, etc.

Internally, you need a dedicated risk-safety individual who will stand up for you but has the temperament to handle drivers, the motoring public, lawyers, etc.

Find someone who is familiar with all the regulations, is safety-conscience, takes pride in your company. This person will represent everything your company stands for.

You will need to find the right insurance adjuster and broker, preferably a trucking expert. Your risk assessor will work with them directly to report accidents as soon as they occur. Your insurance company should advise you on accident best practices, what to document, and even how to act at the scene.

You will also need an attorney with extensive knowledge of the trucking industry. Billboard lawyers will not settle for a new bumper for their client. They want your whole company. Your attorney should be likable, personable, and partners with your risk assessor. If your attorney does not appeal to the jury, it can hurt your case.

Infinit-I Workforce Solution protects your company from nuclear verdicts.

Read More!

55 Things We Learned from an Expert Insurance Underwriter

The CSA program ranks professional drivers based on their performance and safe driving record. CSA points are based on a truck driver’s actions based on the severity of the infraction and then awarded to the driver’s employer. It can be assumed that a company with a high CSA score employs a fleet of unsafe drivers.

The CSA program ranks professional drivers based on their performance and safe driving record. CSA points are based on a truck driver’s actions based on the severity of the infraction and then awarded to the driver’s employer. It can be assumed that a company with a high CSA score employs a fleet of unsafe drivers.

In the haze of fluorescent lights, computer screens, and KPIs, we can become laser-focused on creating the safest and most efficient fleets on the road. In doing so, it is easy to forget your drivers are people. They deserve respect and loyalty, too, especially since their job takes place out on the front lines at the heart of the operation.

In the haze of fluorescent lights, computer screens, and KPIs, we can become laser-focused on creating the safest and most efficient fleets on the road. In doing so, it is easy to forget your drivers are people. They deserve respect and loyalty, too, especially since their job takes place out on the front lines at the heart of the operation.

A urine drug screen may only return accurate results if a controlled substance was used within the

A urine drug screen may only return accurate results if a controlled substance was used within the  Trucking industry leaders are highly concerned about this bill. If marijuana is no longer a controlled substance, it will no longer be included in DOT drug panel tests.

Trucking industry leaders are highly concerned about this bill. If marijuana is no longer a controlled substance, it will no longer be included in DOT drug panel tests.