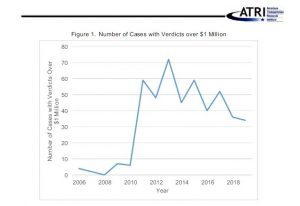

This is the largest verdict against a single trucking company in US History. Let that sink in. I am sure you have heard about this devastating accident. This verdict has made headlines all over the country.

The Synopsis

Duane Washington rode his motorcycle down the interstate on this fateful day, as he often did. Further down the highway, a collision occurred. Having seen the accident, possibly seconds too late, a truck driver jackknifed his tractor-trailer to avoid the collision. A total of 45 vehicles were involved in this accident.

According to Duane Washington’s lawyer, Washington was not able to avoid the jackknifed truck because its emergency lights were not in use. If Washington had seen emergency flashers, he may not have smashed into the back of the truck and been thrown into the median. He may not have suffered life-altering injuries from which he will never fully recover.

If the driver had just turned on his lights in the emergency lane, Top Auto may still have its own authority. They may have been more defensible in court. They may have been able to settle.

This case has set a precedent for all future trials involving commercial motor vehicles.

The Advice

I spoke with a colleague of mine, a safety manager from my previous employment. We reminisced shortly before I turned the conversation to business. I wanted to know his thoughts on the latest nuclear verdict to hit the news.

“What if I was sitting in the courtroom when the $411 million verdict was handed over? How would I explain it to my employees, or to my boss? How would I explain it to my family?”

“What if I was sitting in the courtroom when the $411 million verdict was handed over? How would I explain it to my employees, or to my boss? How would I explain it to my family?”

He went on to admit this kind of loss would be devastating for most trucking companies in operation today.

“Drivers make mistakes. Properly trained drivers make smaller mistakes.”

A simple statement, yet the sentiment echoed in my head for some time. While it is impossible to eliminate human error throughout your fleet, you can dramatically reduce the number of mistakes committed through behavioral changes. Frequent and consistent training brings about small changes over time. Each of those small behavioral changes contributes to safer driving habits, safer drivers, and safer roadways for all.

The Solution

While hindsight may be 2020 now for Top Auto Express, it is far too late for the (no longer operating) trucking company to be proactive in driver training. However, here are a few courses that could have helped them avoid such a damaging verdict:

Collisions, Rollovers, & Jackknifing

- At the Scene of an Accident

- Driver Factors

- Fixed Object Collisions – High Speed

- Fixed Object Collisions – Low Speed

- Highway Factors

- Jackknifing

- Load Effects

Speed and Space Management

- Stopping Distance

- Spatial Awareness

- Incident Avoidance

At the Scene of an Accident

- Be Concerned About Litigation

- Trucking Companies Are Targets

- Do What You Say You’ll Do

- Responding to the Catastrophic Event

- What to Gather at the Scene

- The Care of Your Driver

- Accident Procedures

Uncategorized

- Heavy Trucking Braking System & Braking Techniques

- Inoperative Taillights

- Inoperative Headlamps

- Triangle Placement

- Operating CMV with Lamps – Reflectors Obscured

- Changing Lanes for CMV Drivers

- Tailgating

- Unsafe Driving Acts of Motorists Around Large Trucks

Download your free copy of our course catalog here.

The courses listed above were all available on the Infinit-I platform at the time of the accident. Each of these was an opportunity to create safer driving habits for the drivers of Top Auto Express. Even if the driver had been properly trained, but was not able to avoid the accident, the verdict would have likely been much smaller if he had reacted properly.

“Drivers make mistakes. Properly trained drivers make smaller mistakes.”

The BIG Question

What would a $411 million verdict mean for your company? Join the discussion on our newest LinkedIn page for Trucking Safety Professionals.

If you are not a current client of ours, but you see value in the discussion, follow this link for a quick overview of what our platform can do for you, your company, your drivers, your owners, and other stakeholders such as insurance providers and business partners. Now, you can take advantage of the Infinit-I system absolutely free.

- – Reduced Accidents

- – Reduced Violations

- – Reduced Training Time

- – Reduced Driver Turnover

- – Increased Profitability

- – Increased Litigation Protection

- – Fleet-Wide Communication

- – Simplified Safety Training

Start your complimentary trial today with the most trusted, preferred, and referred learning management system in the trucking industry. Enhance your safety culture and create safer drivers with Infinit-I Workforce Solutions.

Your frequency, consistency, and focus on safety training will prove your commitment to safety. Enhance your safety culture now and positively change driver behaviors before you are faced with legal trouble. Not only will you proactively protect your company from nuclear verdicts, you will be protecting your drivers from injury or death.

Your frequency, consistency, and focus on safety training will prove your commitment to safety. Enhance your safety culture now and positively change driver behaviors before you are faced with legal trouble. Not only will you proactively protect your company from nuclear verdicts, you will be protecting your drivers from injury or death.